2017 China CI Flexo Press Market Report

According to CI Flexo Tech Magazine, in China the estimated total number of CI presses installed increased from 218 in 2016 to 271 in 2017, a 24% increase.

As a country of 1.4 billion population and a rising middle class. The China market has been on the radar for many printing and packaging companies. According to the World Bank, the GDP per capita of China over the last seven years has increased from USD4,560 in 2010 to USD8,826 in 2017, a tremendous 93% increase. As the wealth of the population increases, the demand for consumer goods also increases. As result, this leads to the increase in demand for the printing and packaging that goes along with the product. Below is a study drawn from the well-known Chinese magazine publisher: CI Flexo Tech, on the 2017 China market.

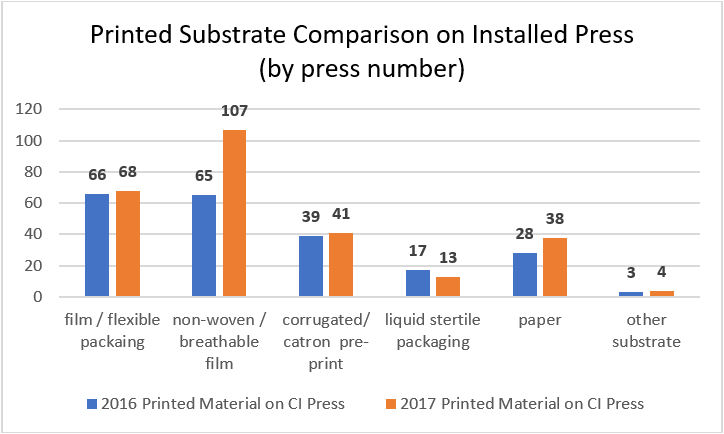

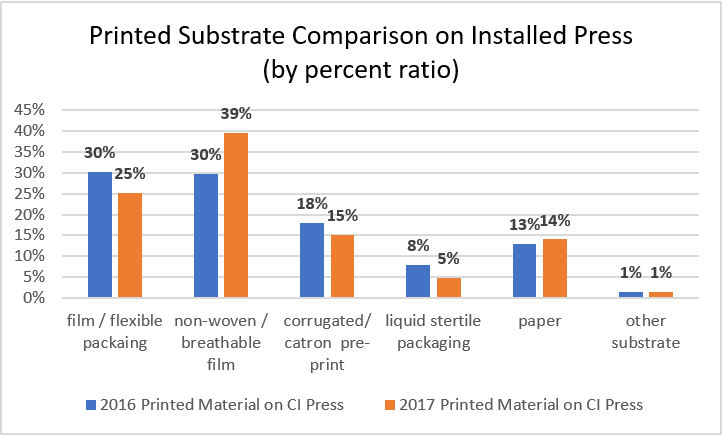

Printed Substrate Study:

Graph 1

Graph 2

As seen from the graph 1, the number of CI press installed for printing non-woven / breathable film has increased dramatically. From graph 2, it is shown that the percentage of non-woven / breathable film CI press installed has also increased dramatically on the China market. Another noticeable increase is the paper application as shown in graph 1.

The growth in non- woven / breathable film can mainly be attributed to the imposing of the two-child policy on Oct 2015, ending the one-child policy since 1979. At the same time with the growth in the African regions. The demand for diapers and sanitary goods increased. The stretchable characteristics of the breathable film made CI printing a much more efficient process than the rotogravure printing process. As result, a big increase in CI flexo press on this particular application.

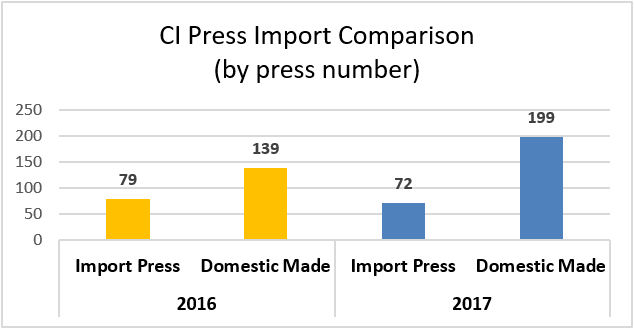

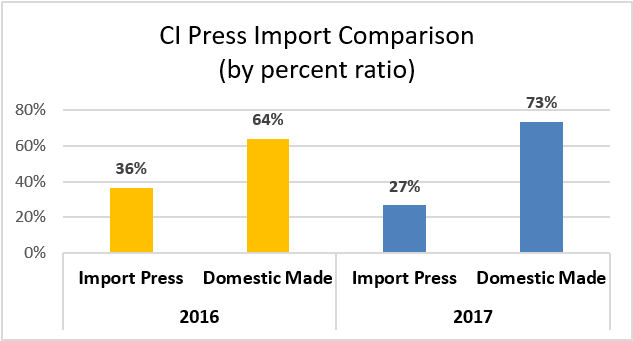

CI Flexo Press Equipment Import Analysis:

Graph 3

Graph 4

The domestic made CI press accounted for the majority of the sales in both 2016 and 2017. The volume of the domestic made press has increased dramatically in 2017. This can indicate that the domestic press manufacturers of the regions are becoming for efficient and competitive on the market.

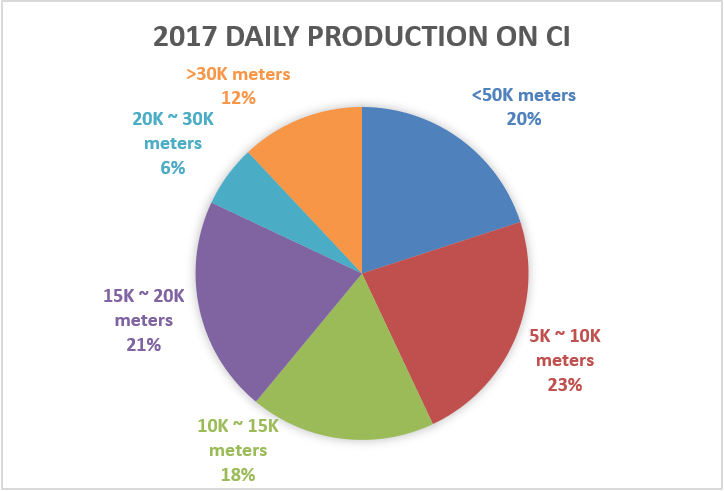

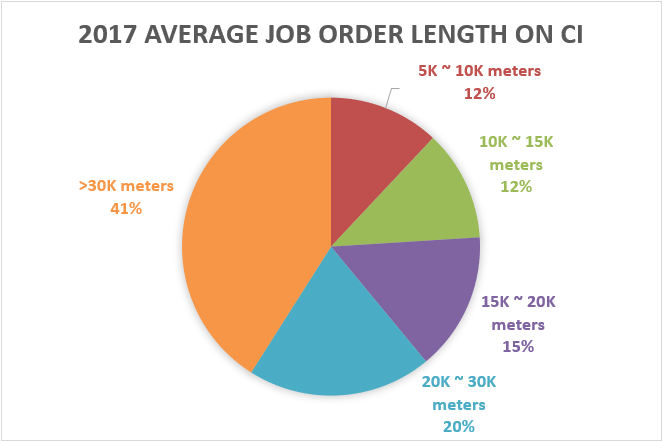

CI Flexo Press Job Order Analysis:

This study was conducted by surveying around 1/3 or the CI press owners in China. Projecting an estimation of the job orders in China

Graph 5

Graph 6

As seen from graph 5, 82 percent of the total daily production on CI is less than 20k meters. If we take 20k meters as an example for our total daily production, when running the press at 300m/min, the job orders would be completed in around 1.1 hours (running nonstop). When the press runs at 200m/min, the job orders would be completed in around 1.6 hours (running nonstop).

From graph 6, 61% of time CI are used to run orders greater than 20k meters. This clearly shows that CI press is the preferred method in running long length jobs. However, as the total daily production length of CI over 20k meters accounts for only 18 percent of the time. This shows that the requirement of the press speed is actually not that high; 300m/min would be more than sufficient.

In conclusion, taking the data above into account, in China the future competition for the flexo press market lies in how efficient and speed of changing jobs and not in how fast the press can run at. When it comes to machine purchases, getting the most value out of an affordable press is vitally important. It is the test of press manufacturers to lower production and operational cost and pass this savings to the customers.

Source: CI Flexo Tech 8th edition 2018.10

Article by Daywey Chen, KYMC