Impact of COVID-19 on the printing & packaging industry in the United States

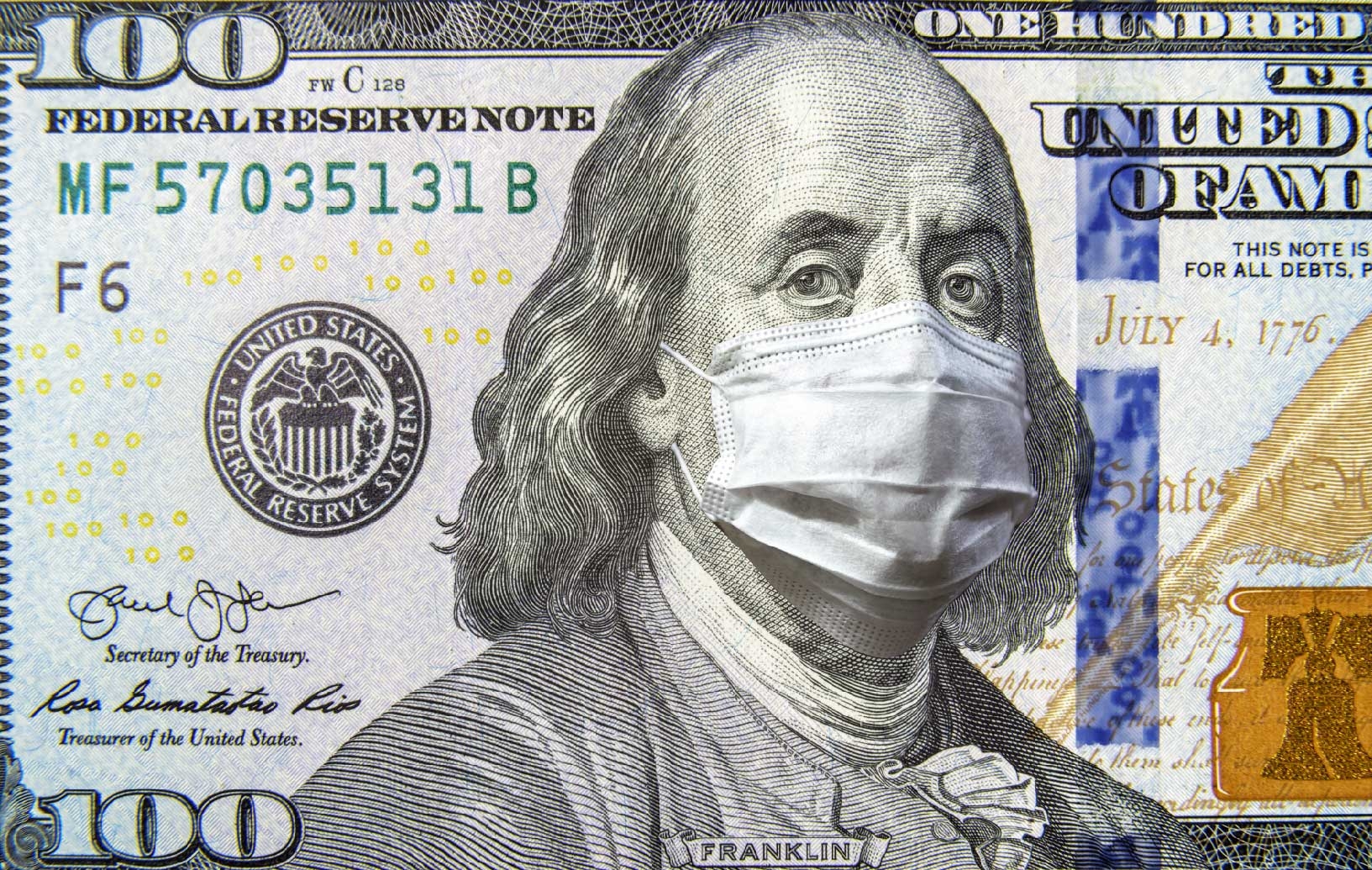

Up to April 9th, 2020 there are reported 430,210 COVID-19 infected cases and 14,736 deaths in the United States. This brings the death rate to 3.42% in the United States. Yes, COVID-19 is a very deadly and serious pandemic when you compared it to the historical death rate of seasonal flu in the United States: 0.1%. That makes COVID-19 34.2 times more deadly. So, how does this impact the printing & packaging industry in the United States? In the article, we will discuss about what’s happening now, and what is expected to happen in the mid to long term.

Let’s be honest, the US government and a big portion of the citizens of the United States were too ignorant to take COVID-19 seriously initially. As result, the United States now ranks number one when it comes to the cases of infection and mortality, given China had provided an honest figure which I doubt. However, even now some states are taking sweeping action while others are taking a limited approach. Let’s look at some key states.

California: schools were ordered closed, and businesses that does not provide essential services were ordered closed. Restaurants are ordered closed but will still be able to deliver carry-out orders.

Illinois: schools are closed, and all non-essentials businesses will be closed, and residents are told to stay home, but are still permitted to go to the grocery store, pharmacy, doctor’s office and perform other necessary tasks.

New York: declared a state of emergency. Restaurants and cinemas will close starting March 16th , as the same for neighboring state New Jersey and Connecticut. The states also limited recreational and social gatherings to 50 people. All non-essential workers to stay home and ordered the closure. Restaurant carry-out is prohibited.

In general, non-essential businesses were asked to close in the more severe cities. So the question now is “Is printing & packaging essential?” From an advisory memorandum issued by the U.S Department of Homeland Security on March 28th, 2020. The below were advised to be considered essential.

“Food manufacturer employees and their supplier employees—to include those employed in food ingredient production and processing facilities; livestock, poultry, seafood slaughter facilities; pet and animal feed processing facilities; human food facilities producing by-products for animal food; beverage production facilities; and the production of food packaging.”

“Farmers, farm workers, and agribusiness support services to include those employed in auction and sales: grain and oilseed handling, processing and distribution; animal food, feed, and ingredient production, packaging, and distribution; manufacturing, packaging, and distribution of veterinary drugs; truck delivery and transport; farm and fishery labor needed to produce our food supply domestically and for export”

“Employees of firms providing services, supplies, and equipment that enable warehouse and operations, including cooling, storing, packaging, and distributing products for wholesale or retail sale or use. Includes cold- and frozen-chain logistics for food and critical biologic products.”

“Manufacturers and distributors (to include service centers and related operations) of packaging materials, pallets, crates, containers, and other supplies needed to support manufacturing, packaging staging and distribution operations.”

“Workers supporting the safe transportation of chemicals, including those supporting tank truck cleaning facilities and workers who manufacture packaging items”

“Workers who support the production and transportation of chlorine and alkali manufacturing, single-use plastics, and packaging that prevents the contamination or supports the continued manufacture of food, water, medicine, and other essential products, including glass container manufacturing.”

From the industry, how are the big packaging companies that are headquartered in the United States or have plants in the United States responding to COVID-19? On March 24th, 2020 Amcor announced that it will continue to operate to make sure that customer has continuous access to its product while keeping its employees safe. Similar announcements had came out from Mondi, Syntegon, Tetra Pak and UPM. These companies are following the latest guideline from the World Health Organization, including actively monitoring the developing situation, restricting travel, and quarantine protocols for employees. Additionally, some companies have set up screening at office and manufacturing locations and disinfecting its locations.

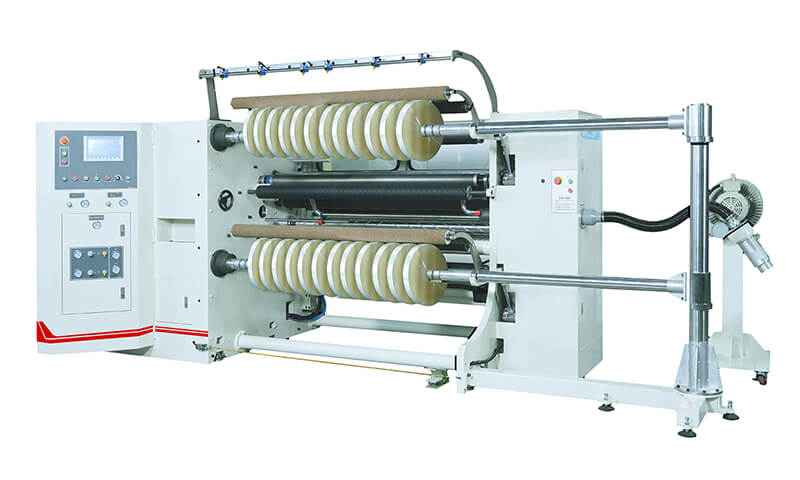

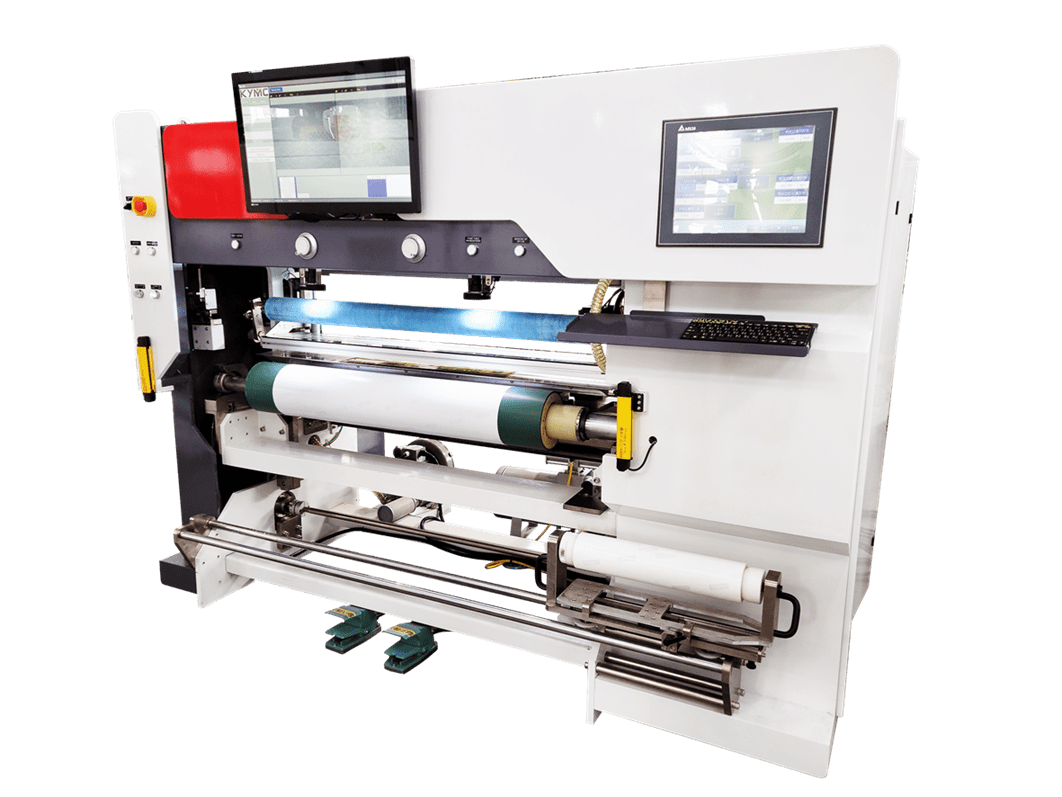

Amid the crisis, from an economic standpoint the printing and packaging industry is doing fine in the United States. Yes, there are some shortage of supplies due to the shutdown in the raw material suppliers from countries such as China and India. but overall, the industry is doing fine. The demand for packaging has increased as people are panicking and demanding more take-out deliveries, online orders, groceries, sanitary products, facial masks and FMCG. KYMC has reached out to our customers in the North American region, asking them about their state. Most companies responded they are still going strong and are open for business for the supply chain of food and critical supplies. The challenge now for the printing and packaging industry is how to keep their employee safe? Furthermore, how to keep their employee motivated during work? At the end of the day, you don’t want an employee to think “why should I risk my life for a cardboard box?”

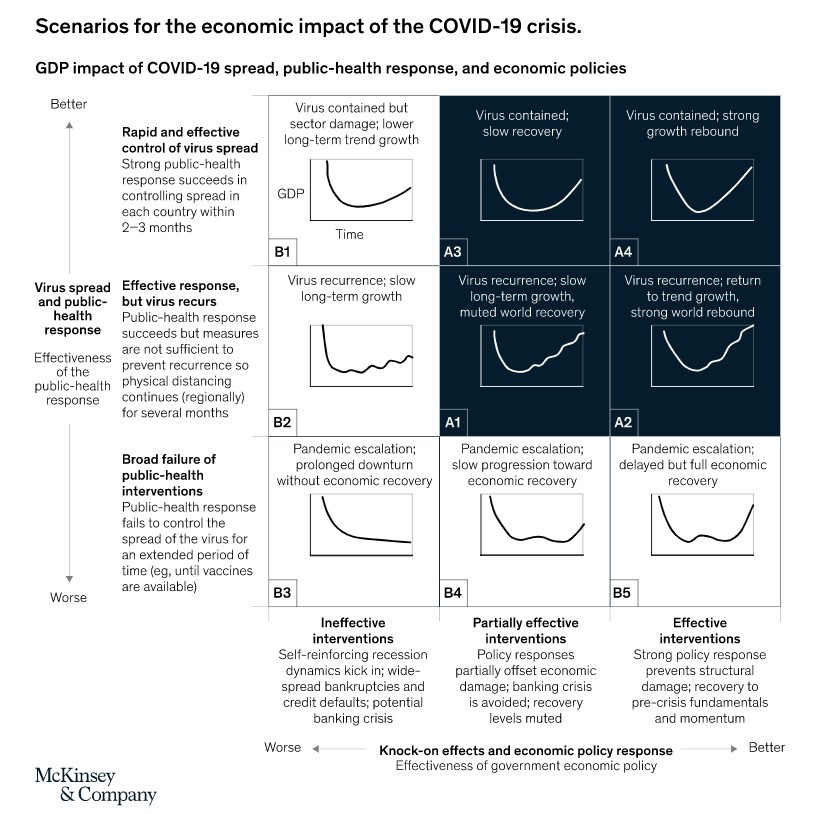

Yes, in the short-term people are panicking and demanding more packaged products. Therefore, the printing and packaging industry is doing fine. However, in the mid-term we need to think about how the consumers are going to continue to pay for these goods when they are out of work for months, and when companies are going into bankruptcy. Notice when I mentioned the US packaging industry is still going strong, I mean in the short term. Eventually the printing and packaging industry is going to be affected by the struggling US economy. A report from Mckinsey & Company, the USA 2020 GDP is forecasted to grow by - 2.7%. Moreover, with many of the cities being shutdown the US economy is going into a recession. Now the two critical questions that people are trying to answer is “will the economy go into a depression?”, and “how long will it take for the US economy to recover from COVID-19?” According to Mckinsey &Company, the answer to these two questions will be dependent on two main factors. One, the effectiveness of the public health response and two, the effectiveness of the government policy. Have a look at the chart below.

The ideal situation would be A4, which will be a quick V shape jump back recovery. The worst-case scenario would be B3 where there will be no recovery in the mid-term. This is when the country fails to contain the virus and the government is ineffective in its interventions.

In the long term, COVID-19 is expected to generate a paradigm shift in the consumer perception of food safety. As result, the consumer behavior will change. Here are a few things that we expect to happen in the long term

Increase in demand for packaging: eco-friendly V.S product safety

As people are becoming more concerned about the environment and sustainability, people are switching to more eco-friendly alternatives. In many cases people are trying to reduce the amount of packaging. However, COVID-19 has changed that. What was previously seen as unnecessary packaging or over packaging are now seen as essentials. Consumers are now becoming more aware of the germs being transmitted through surface. Consumers begin to ask themselves, “Who else has touched the banana or apple displaying at the supermarket?” Many will prefer their products being wrapped for safety concern.

The global coffee chain Starbucks announced in early March that it has placed a temporary ban on reusable cups as an effort to prevent further spread of COVID-19. If you are familiar with Starbucks, the global coffee chain had introduced its reusable cup reward system to meet its environmental goals, where customers can obtain discounts by bringing their own cup or tumbler to fill their drinks. When the pandemic is over, businesses will have to find a balance between being eco-friendly and product safety.

Increase in demand for paper packaging

The demand for hygienic packaging is expected to surge. With the recent finding that COVID-19 can live up to 72 hours on plastics, and only 24 hours on paper. It is expected that the couscous consumer pool will start to carefully inspect packaging materials and opt for paper and paperboard-packaged good in the prevention of germs, bacteria and viruses. These demands could be applied in all FMCG goods and may force brands to adjust their packaging type. It is expected to bring opportunities for the paper producing and packaging companies.

Reallocation of the printing and packaging supply chain

In the business world, trust has always been a crucial factor. Can I trust this government? Can I trust the localities’ political stability? Can I count on the incumbent authority being truthful about the information that they release to the public? Yes, the world will get back to China when this is all over. China will have to pay for its debt. China has lost the trust of the world. As result many companies will think twice about investing in China. Many of the supply chains will move out of China and reallocate to the South East Asian region or come home to the United States.

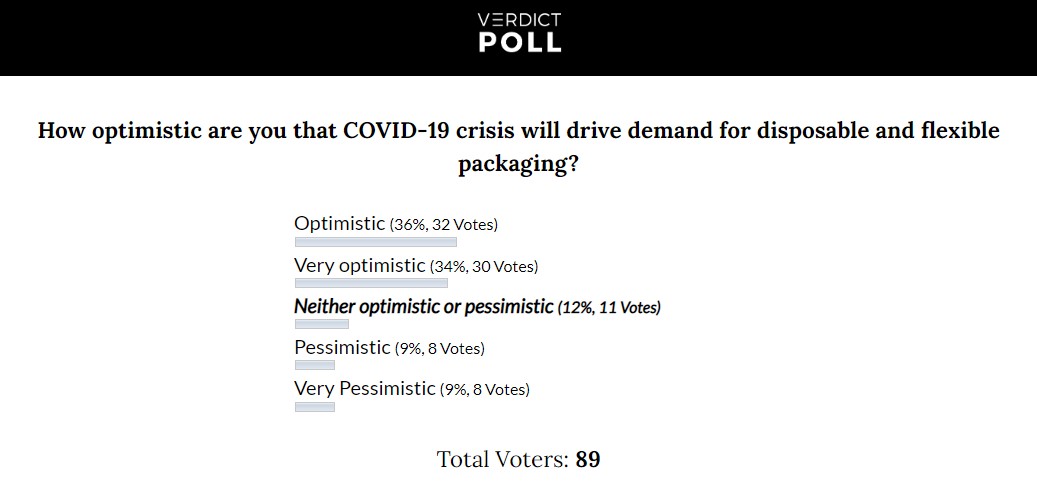

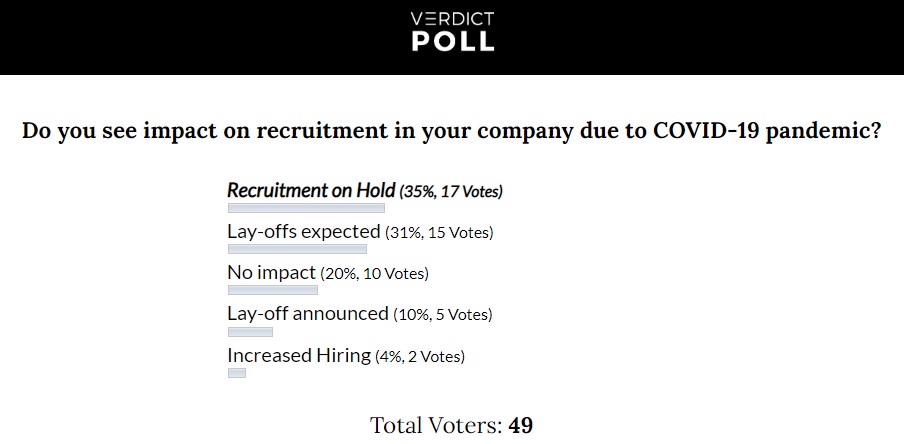

Even though the overall printing and packaging market are expected to grow in the long-term, printing and packaging companies are reluctant to make investment in the short term amid uncertainty. The uncertainty of how long this crisis is going to last. Let’s look at a poll result conducted by Packaging Gateway, a leading media for the packaging industry. 70% of the company responded “optimistic” or “very optimistic” when asked about how optimistic they are in the increase in demand for disposable and flexible packaging due to COID-19. However, only 4% voted that their current company recruitment activity have increased amid the crisis. A very interesting phenomenon has been developed: companies are optimistic about the future but are not putting in the resources to invest in the future.

Sources:

https://www.weforum.org/agenda/2020/03/economic-impact-covid-19/

https://www.packaging-gateway.com/features/how-are-packaging-companies-responding-to-covid-19/

https://www.packaging-gateway.com/news/starbucks-corona-virus/

https://www.packaging-gateway.com/comment/paperboard-covid-19-hygienic-packaging/

https://www.packaging-gateway.com/comment/sterile-antiviral-packaging-covid-19/