Recommendation to choosing the best flexo press for 2021

As we are about to enter the last month of the 1st quarter 2021, COVID-19 has shown no significant signs of slowing down. Who knows when this will be over or what will happen next? Uncertainty is the trend for 2021. Amid this uncertainty, how should printers make their flexo press investment decisions? In this guide, we will provide some recommendations for the purchasing decision cycle.

Evaluating your potential business scenarios for the next five years

As uncertainty is greater than ever, you need to think broader than ever. You not only have to think in terms of the short term but in the mid to long term as well. In the different periods, what is your worst-case scenario? We all like to think positively and look forward to a bright future. You may be investing in a new flexo press because you have received a promised large order for the next few years from a client. You may be investing in a new flexo to expand your product line. Ok, that’s great, but what if it doesn’t work out. What if your promised large order never came in? What if your order came in but was half of the promised volume? What if you were unable to bring on new customers with your expanded product line? You need to think about all the “What if”. You need to put on your pessimistic attitude. In your worst-case scenario, how long will you be able to last if the expected incoming cash flow falls short? Will you be able to renegotiate your terms with your financial institution? Will you be able to sell off the machine as a used one? Will layoffs be needed and how much it will cost you to layoff your employees?

You need to go through as much of the “What if” scenarios as possible. However, this won’t guarantee that everything will work out in the end. This only gives you a picture of the risk that you are going up against. To help you make a better-informed decision. At the end of the day, if the risk is too great, or if the potential risk outweighs the potential benefit, then maybe investing in a new flexo press is not an option for you.

It is a game of probability. Let’s say you are 50% certain to receive 1 million per month from your clients. There is a 30% chance that you only receive half of that, 0.5 million per month and 10% chance of receiving nothing and 10% chance for receiving 1.2million in your best case scenario, then your expected revenue should be :

Expected Revenue = 1M(0.5) + 0.5M(0.3) + 0M(0.1) + 1.2M(0.1) = 0.77M

In terms of cost, you can breakdown your potential cost into fix cost and variable cost. Fix cost can include cost such as machine down payment, machine installments, labor cost, factory cost, warehouse cost…etc. The variable cost can include costs such as material cost, utility cost, sales and marketing cost, and other administrative costs.

It is also good to go back to your company’s current financials. To understand at what state your company is at financially. For instance to go back to your current assets, cash and cash equivalents, long terms assets, short term liabilities, long term liabilities. To look at metrics such as current ratio and cash ratio to measure your company’s current ability to repay the financial obligations. To look at metrics like debt ratio to evaluate if your company is already taking on too much debt. To look at metrics like Asset turnover ratio, inventory turnover ratio, receivable turnover ratio, days sales in inventory ratio to evaluate how efficient your company currently is in utilizing its assets and resources. Last but not least, look at your current gross margin, operating margins, and net income. To evaluate will investing in the new flexo press machine improve your gross margin, operating margins, and net income or not?

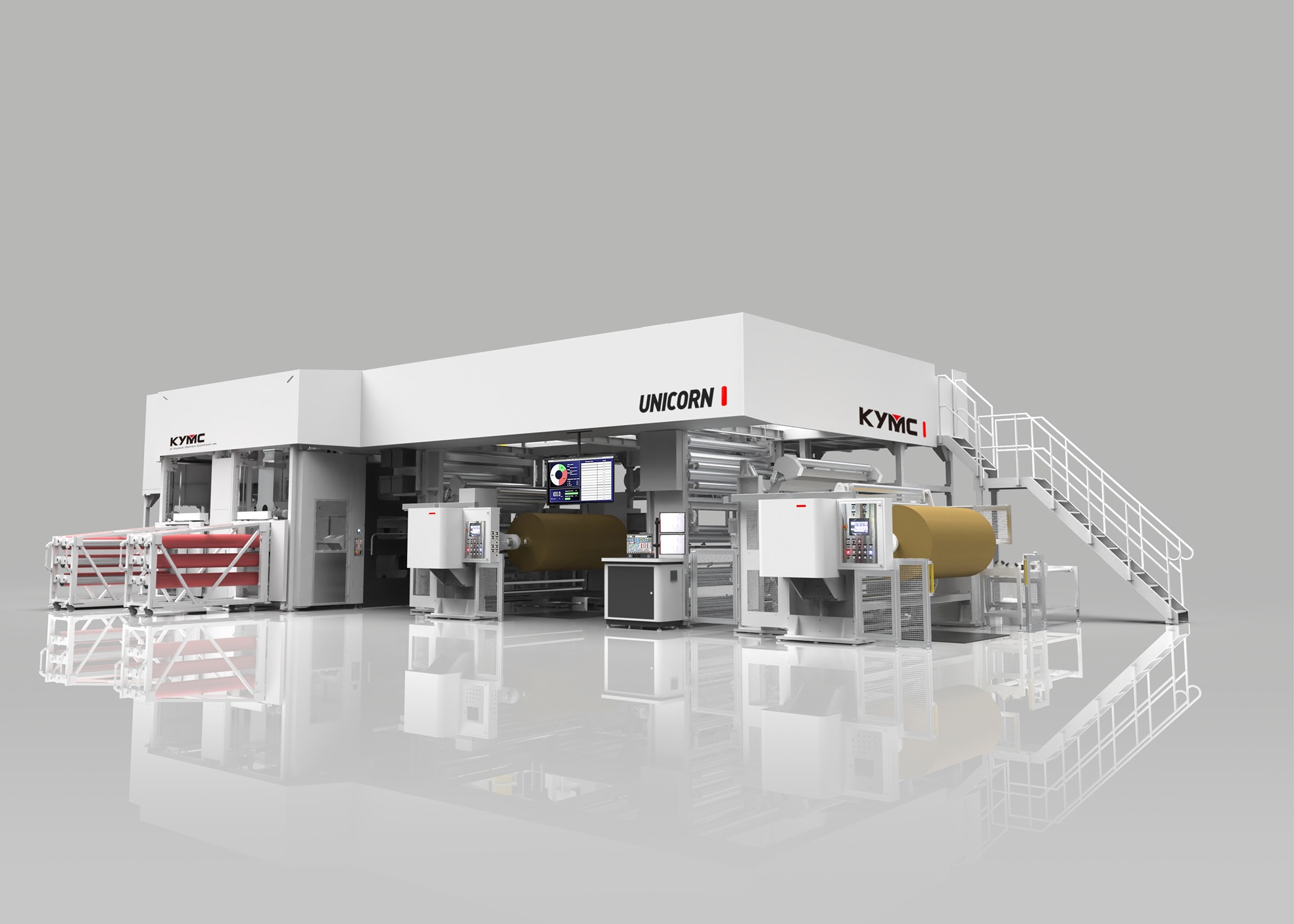

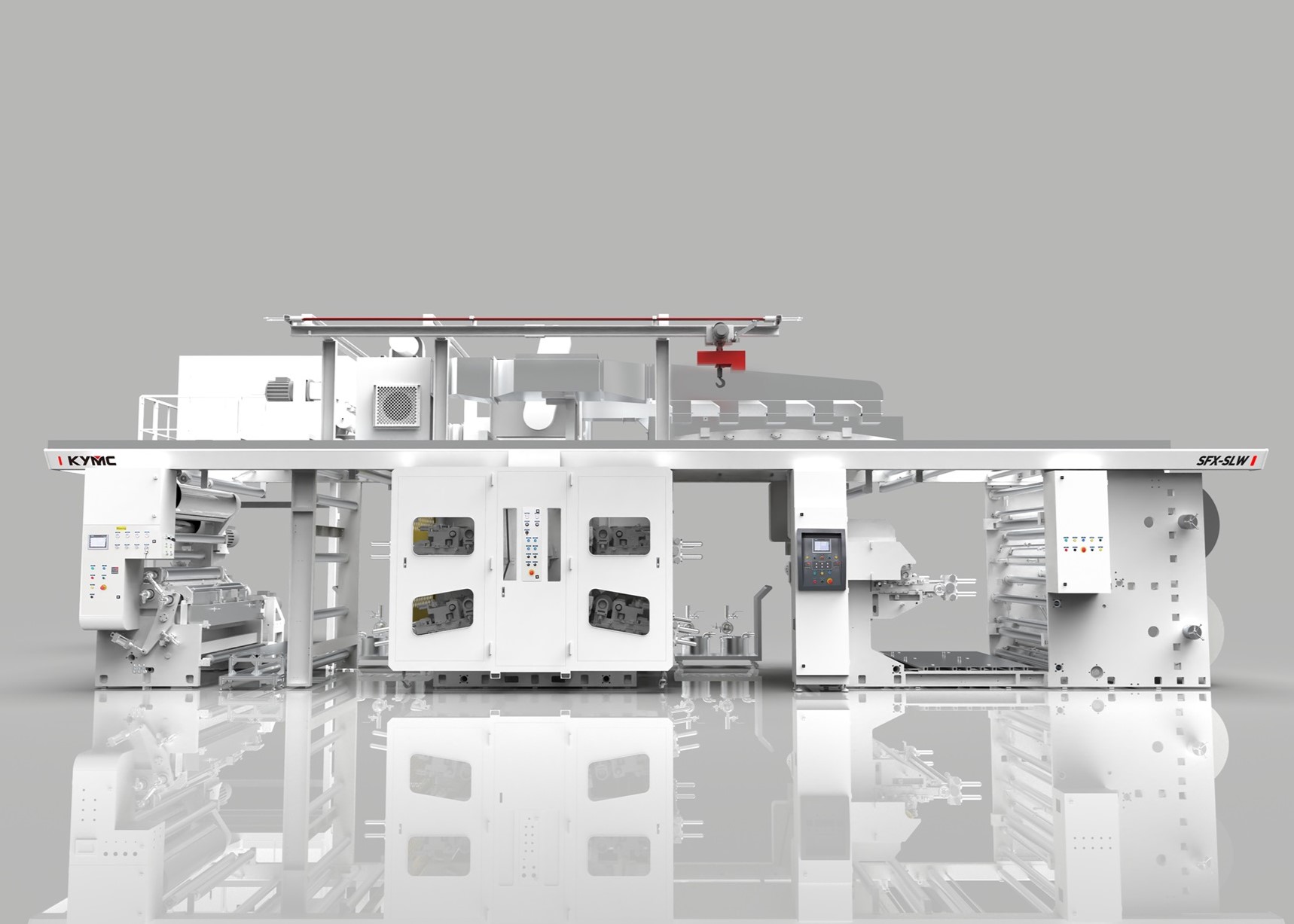

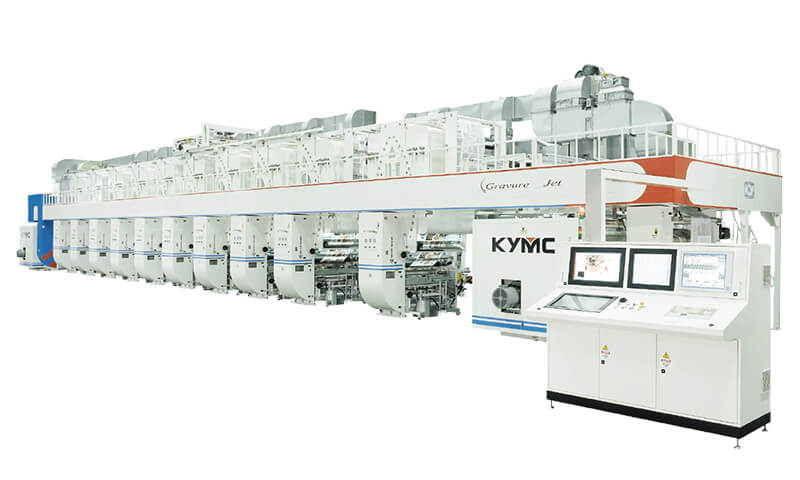

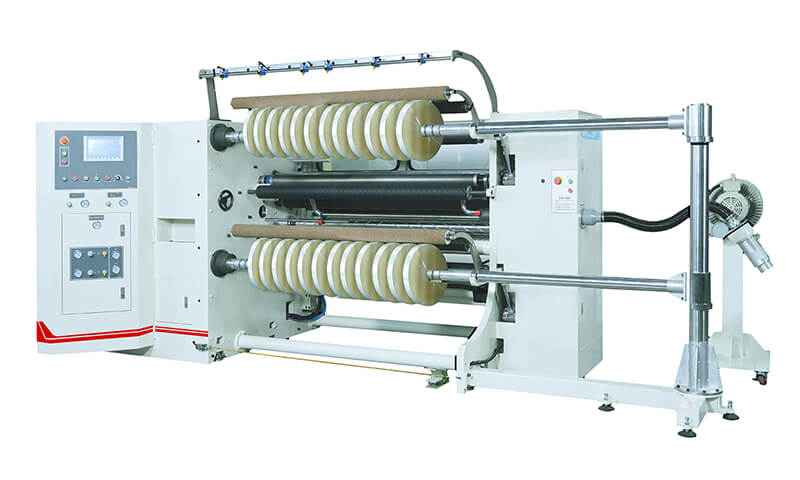

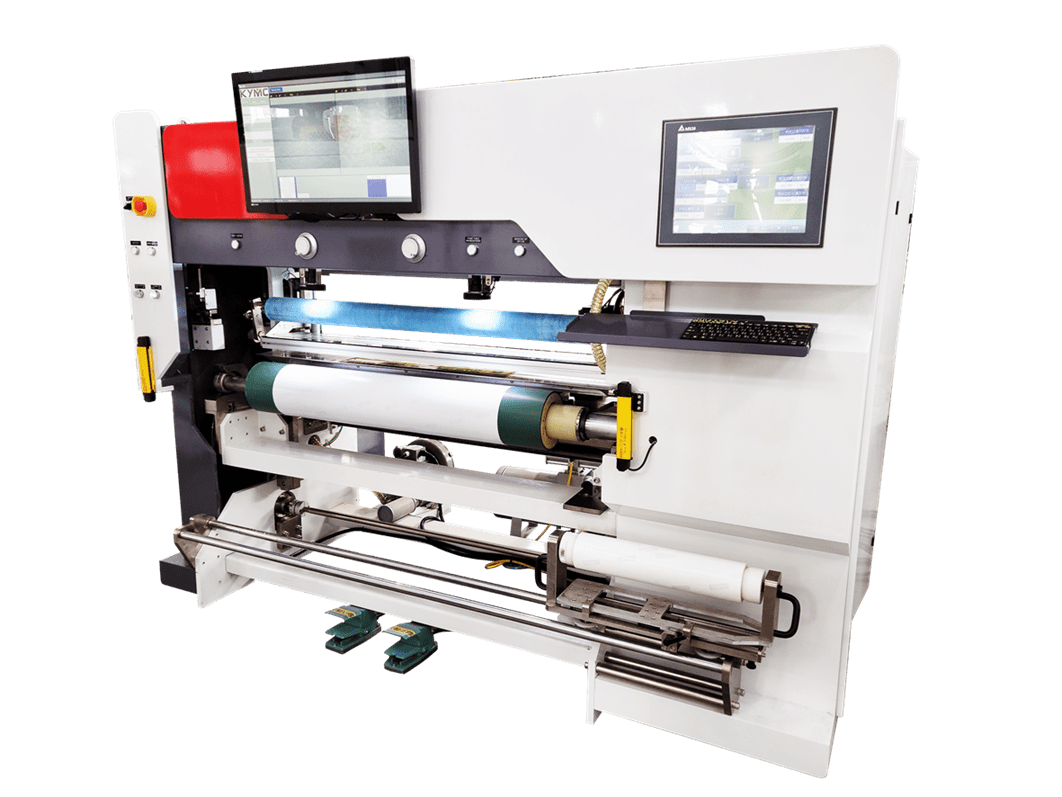

Deciding on your machine specification

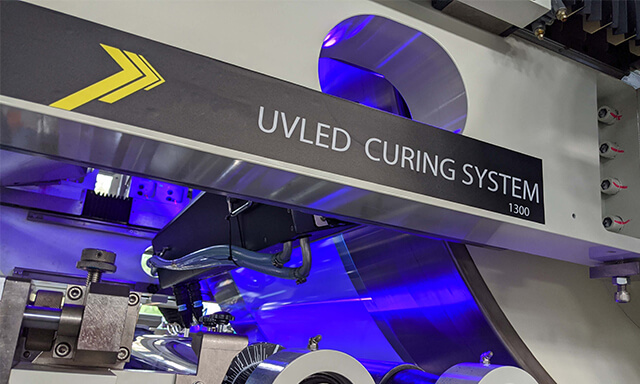

Let’s say after evaluating the risks. The company decided to go forward with the investment. The next step is to decide on your machine specification base on your budget range. You need to connect the dots between the risk and specification. For instance, the more you customize your press, the harder you are going to be able to sell it on the used market in the future. A higher specification often means investment towards the higher end of your budget. To have machine specifications meet your current needs or to plan further ahead to include specifications that will take into account future potential orders. For instance, a stack flexo press is sufficient to meet the registration tolerance on the current jobs, do you want to invest in a CI flexo press instead to secure your future potential order that requires higher registration toleration? You are currently working on water-based ink. Do you want the flexibility to be able to print in UV-LED inks by investing in a hybrid press? Your job runs are getting shorter and shorter, do you want to invest in an auto washing and auto viscosity control functionality, or do you want to do it manually? Try to find a balance between flexibility and risk in the short, mid, and long term.

How to make your machine operational, and continue to be operational

Investing in a machine is only a start. You need to make sure the flexo press will be operational in your factory. Do you have the right talent to run the press? Is talent easy to source or train in your region? Do you have the right supplier in your region to supply your needed materials? What are the options for your operational supply? Are you tied to one or two suppliers, or do you have myriads of options? Do you have someone to go to when your flexo machine goes down? What type of support is provided by the press manufacturer? Define the service level agreement ahead of time.

We wish that 2021 will be a better year than 2020. However, you never know…Therefore you should take into account more scenarios than ever. You should be more careful when evaluating the potential risks. You should be more pessimistic about your worst-case scenarios. The ones that will be able to connect the dots between risk and opportunities will strive through the difficult 2021.

Article by Daywey Chen, KYMC