What You Should Know About The Printing Industry: Merger & Acquisition Trend

June 1, 2018 | Daywey Chen

2018-07-16

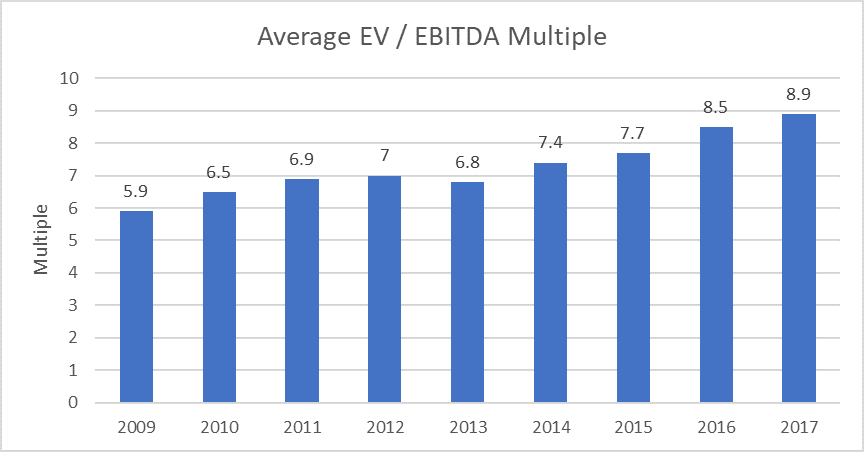

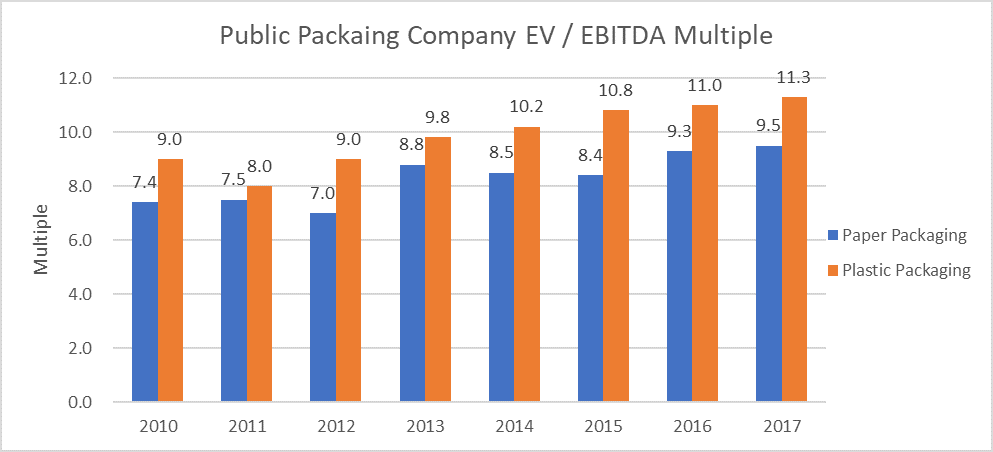

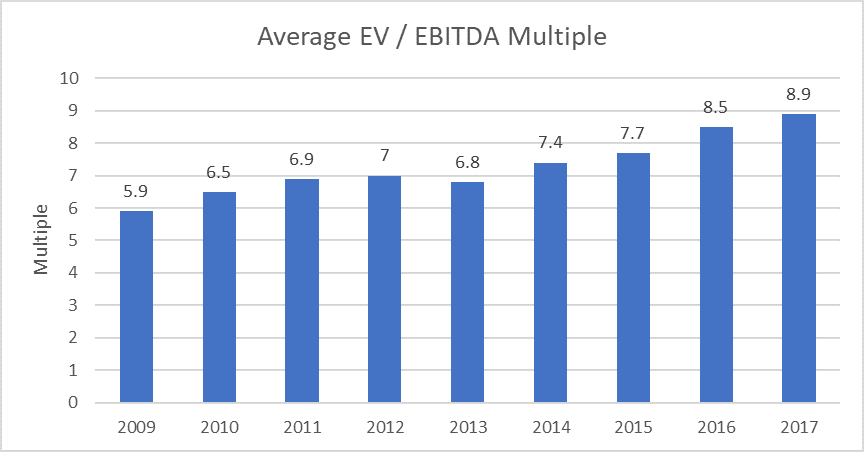

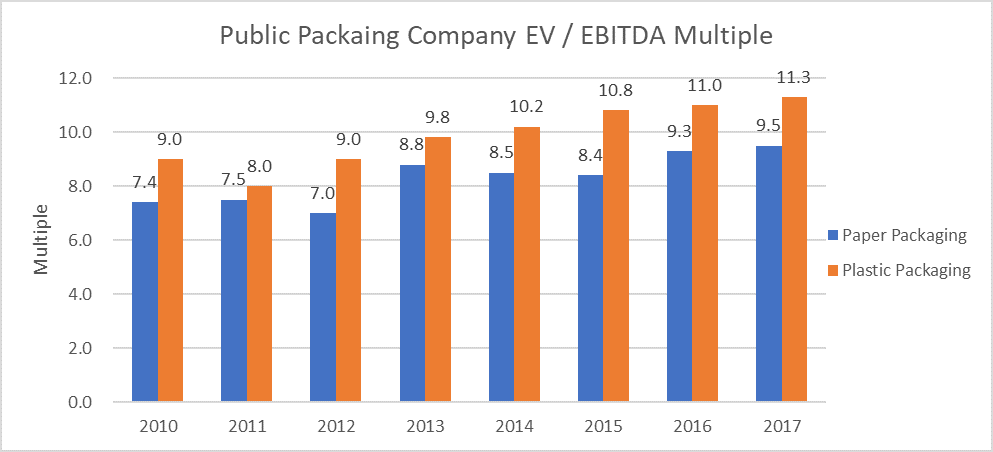

Whether it is an investment from private equity, a strategic merger or an acquisition, the M&A activities in the printing industry are going strong for both buyers and sellers. According to Capstone Partners, there were 88 disclosed M&A deals in 2011 and 133 deals in 2016 within the USA printing and packaging industry. In terms of selling value, according to Mesirow Financials, the average EBITDA multiples for packaging M&A transactions had grown from 5.9x in 2008 to 8.9x in 2017, a 50-percentage increase as shown in figure 1. According to S&P Capital IQ, in the public packaging company areas including firms like Amcor, Bemis, Berry Plastic Group, Sealed Air, WinPak, Greif, International paper, WestRock…etc., on average the EBITDA multiple for Plastic index beats the Paper Index as shown in figure 2.

FIGURE 1

FIGURE 2

So, what are the reasons behind these M&A within the printing industry? In this article, we discuss the M&A trends from both the buyer and seller’s perspective.

There are two types of buyers, the financial acquirer looking to add to their investment portfolio and the printing and packaging firms looking to grow their business. The acquisition activities from the financial buyers versus printing and packaging company owners are due to the few key factors identified below

Buyers - Financial Investors

Steady Growth

The printing and packaging industry revenue continues to grow steadily over the years. According to Smithers Pira, forecasting an annual growth rate of 3.5% until 2020. According to ink world magazine, forecasting a CAGR of 4.7%. In the recent years, the percentage financial acquirer on the market had increased dramatically.

Investment Portfolio Risk Mitigation

The industry shows defensive characteristics and strong cash flows. The flexible packaging companies showed resiliency on a relative basis during the recession, especially for companies focusing on the food and healthcare sectors. Many investors view flexible packaging industry as a relatively recession-proof investment.

Buyers – Printing and packaging company owners

Fast penetration into new geographic markets, expanding customer base without the need for organic growth

A recent industry case would be the merger between Prolamina and Ampac to form ProAmpac in August 2015. The merger created a diversified global packaging company with over 2,000 employees and 16 manufacturing facilities in North America, Europe, and Asia.

Fast penetration into new product lines and new technologies, increasing service offerings and competitive advantage

Continuing with the example of ProAmpac, “Our goal was to create a strong, North American-centric flexible packaging company. We accomplished this by consolidating these midlevel competitors with facilities that have assets and capacity targeted toward the faster-growth niches in flexibles. ProAmpac can now offer a full suite of technologies, products, and manufacturing techniques in high growth niche markets, including pet food, healthcare, frozen food, and liquids. Being a leader in pouching, both through extrusion and adhesive lamination” mentioned by Greg Tucker, CEO of ProAmpac.

Increase profitability through greater economy of scale

M&A to achieve greater economy of scale by the sharing of resources and by the increasing bargaining power towards suppliers within the supply chain. “There’s an opportunity to take a bunch of these companies and bring them together in consolidation to get the benefits of the economies of scale,” says Macfarlane Group chief executive Peter Atkinson.

There are also two different types of sellers, private equities looking for a profit gain through their investment sell off versus the owners that actually participates in the daily operation of the company.

Seller – Financial investors

Profit from investment

Private equity to private equity transactions is becoming more common. According to Pitchbook, there is a 76% increase in private equity to private equity transaction from 2006 to 2014. Taking the ProAmpac company as a private equity to private equity transaction example. ProAmpac was sold to Pritzker Group from Wellspring Capital Management in October 2016, both a private equity company.

Seller- Printing and packaging company owners

Retirement

The Baby boomers are reaching retirement age. As many of the small-medium size printing and packaging companies are family owned, companies with no succession plan either because the younger generations are pursuing other careers or has no interest in the printing sector are looking for alternatives to end their businesses.

Asset diversification

As owners of the company would sometimes sell a portion of the company to generate liquid asset for other areas of investment. To diversify his area of investment.

In our next two articles, we will discuss how you should strategically prepare yourself as a small-medium size company if you are looking to sell off the company. On the other hand, how you should strategically prepare yourself if you are planning to remain in business on the market.

Article by Daywey Chen, KYMC

FIGURE 1

FIGURE 2

So, what are the reasons behind these M&A within the printing industry? In this article, we discuss the M&A trends from both the buyer and seller’s perspective.

There are two types of buyers, the financial acquirer looking to add to their investment portfolio and the printing and packaging firms looking to grow their business. The acquisition activities from the financial buyers versus printing and packaging company owners are due to the few key factors identified below

Buyers - Financial Investors

Steady Growth

The printing and packaging industry revenue continues to grow steadily over the years. According to Smithers Pira, forecasting an annual growth rate of 3.5% until 2020. According to ink world magazine, forecasting a CAGR of 4.7%. In the recent years, the percentage financial acquirer on the market had increased dramatically.

Investment Portfolio Risk Mitigation

The industry shows defensive characteristics and strong cash flows. The flexible packaging companies showed resiliency on a relative basis during the recession, especially for companies focusing on the food and healthcare sectors. Many investors view flexible packaging industry as a relatively recession-proof investment.

Buyers – Printing and packaging company owners

Fast penetration into new geographic markets, expanding customer base without the need for organic growth

A recent industry case would be the merger between Prolamina and Ampac to form ProAmpac in August 2015. The merger created a diversified global packaging company with over 2,000 employees and 16 manufacturing facilities in North America, Europe, and Asia.

Fast penetration into new product lines and new technologies, increasing service offerings and competitive advantage

Continuing with the example of ProAmpac, “Our goal was to create a strong, North American-centric flexible packaging company. We accomplished this by consolidating these midlevel competitors with facilities that have assets and capacity targeted toward the faster-growth niches in flexibles. ProAmpac can now offer a full suite of technologies, products, and manufacturing techniques in high growth niche markets, including pet food, healthcare, frozen food, and liquids. Being a leader in pouching, both through extrusion and adhesive lamination” mentioned by Greg Tucker, CEO of ProAmpac.

Increase profitability through greater economy of scale

M&A to achieve greater economy of scale by the sharing of resources and by the increasing bargaining power towards suppliers within the supply chain. “There’s an opportunity to take a bunch of these companies and bring them together in consolidation to get the benefits of the economies of scale,” says Macfarlane Group chief executive Peter Atkinson.

There are also two different types of sellers, private equities looking for a profit gain through their investment sell off versus the owners that actually participates in the daily operation of the company.

Seller – Financial investors

Profit from investment

Private equity to private equity transactions is becoming more common. According to Pitchbook, there is a 76% increase in private equity to private equity transaction from 2006 to 2014. Taking the ProAmpac company as a private equity to private equity transaction example. ProAmpac was sold to Pritzker Group from Wellspring Capital Management in October 2016, both a private equity company.

Seller- Printing and packaging company owners

Retirement

The Baby boomers are reaching retirement age. As many of the small-medium size printing and packaging companies are family owned, companies with no succession plan either because the younger generations are pursuing other careers or has no interest in the printing sector are looking for alternatives to end their businesses.

Asset diversification

As owners of the company would sometimes sell a portion of the company to generate liquid asset for other areas of investment. To diversify his area of investment.

In our next two articles, we will discuss how you should strategically prepare yourself as a small-medium size company if you are looking to sell off the company. On the other hand, how you should strategically prepare yourself if you are planning to remain in business on the market.

Article by Daywey Chen, KYMC